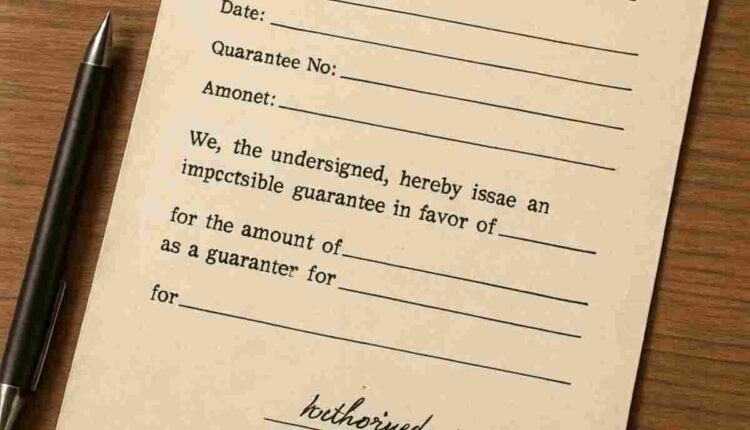

Before diving into how to choose a provider, it’s important to understand what a bank guarantee is. Essentially, it’s a promise from a bank that they will cover a debtor’s financial obligations if the debtor fails to do so. This can provide peace of mind in both business and personal transactions. Discover the best info about bank guarantee provider.

Definition and Purpose

A bank guarantee serves as a safety net in financial transactions. It ensures that if a party fails to fulfill a financial obligation, the bank will step in and cover the loss. This assurance can make or break deals, especially in international trade where trust may be hard to establish.

How Bank Guarantees Work

When a bank issues a guarantee, it evaluates the risk involved and sets terms accordingly. The bank charges a fee for this service, which varies based on the guarantee’s value and duration. Once in place, the beneficiary can claim the guarantee if the principal defaults, providing a financial safety net.

Real-World Applications

Bank guarantees are used in various scenarios. For businesses, they facilitate transactions by assuring suppliers and clients of payment security. In personal finance, they might be used to secure rental agreements or loans, ensuring landlords or lenders that they will receive payment even if the principal defaults.

Types of Bank Guarantees

There are several types of bank guarantees, each serving different purposes. Some of the most common include:

Financial Guarantee

A financial guarantee ensures that a payment will be made even if the principal defaults. This type is crucial in large transactions, such as real estate deals, where financial stakes are high. It provides the seller with confidence that they will receive payment, reducing the risk involved in the transaction.

Performance Guarantee

A performance guarantee ensures that contractual obligations will be fulfilled. This is often used in construction or service contracts to ensure that the project will be completed to the agreed specifications. It protects the client from losses if the contractor fails to deliver the promised results.

Advance Payment Guarantee

An advance payment guarantee protects the buyer if the seller fails to supply goods or services after receiving an advance. This type of guarantee is common in international trade, where buyers pay in advance to secure goods. It assures the buyer that they will either receive their goods or get their money back.

Bid Bond Guarantee

A bid bond guarantee supports a contractor’s bid for a project. It ensures that the contractor will honor the terms of the bid if awarded the contract. This guarantees the project owner that the contractor has the financial backing to undertake the project.

Warranty Guarantee

A warranty guarantee protects the buyer by ensuring that any defects will be rectified within a specified period. This is commonly used in the sale of goods, providing the buyer with assurance that the product will meet certain quality standards.

Why Choose a Reliable Provider?

Selecting a trustworthy bank guarantee provider is critical because it directly affects your financial security. A reliable provider not only stands by their guarantees but also offers transparent terms and responsive customer service.

Importance of Credibility

A provider’s credibility is paramount. A credible provider has a track record of honoring guarantees, which instills confidence in their clients. This reliability is especially crucial in transactions where large sums of money are involved, as the financial stakes are high.

Impacts on Business Reputation

Choosing a reputable provider can enhance your business’s reputation. When partners know that you work with a reliable bank, it reflects positively on your business practices. This can open doors to more opportunities and partnerships, as trust is a key component of business relationships.

Long-term Financial Security

Working with a reliable provider ensures long-term financial security. You can rest assured that your transactions are backed by a strong institution, minimizing the risk of financial loss. This stability is essential for both personal and business financial planning.

Steps to Choose a Reliable Bank Guarantee Provider

Research and Compare Providers

Start by researching different providers. Look into their reputation, customer reviews, and industry standing. Comparing providers will give you a sense of who offers the most reliable services.

Evaluating Provider Reputation

Check industry reviews and ratings to gauge a provider’s reputation. Look for awards or recognitions they have received, as these can indicate reliability. Client testimonials can also offer insights into the provider’s service quality and dependability.

Analyzing Customer Feedback

Read customer reviews to understand the provider’s strengths and weaknesses. Pay attention to recurring themes in feedback, such as customer service quality or issues with guarantee processing. This information can help you make an informed decision.

Comparing Industry Standing

Compare the provider’s standing within the industry. Are they a leader or a newcomer? Established providers often have more resources and experience to manage guarantees effectively. However, new entrants might offer competitive rates and innovative services.

Evaluate Their Financial Strength

A provider’s financial strength is a key indicator of their ability to honor guarantees. You can assess this by looking at their credit ratings and financial statements. A provider with strong financial health is more likely to fulfill their obligations.

Assessing Credit Ratings

Credit ratings provide a snapshot of a provider’s financial health. High ratings suggest stability and reliability, indicating that the provider is less likely to default on obligations. Review ratings from multiple agencies for a comprehensive view.

Reviewing Financial Statements

Examine the provider’s financial statements for insights into their financial health. Look at their balance sheet, income statement, and cash flow statement to gauge their financial stability. Strong financials suggest a lower risk of defaulting on guarantees.

Analyzing Market Position

Consider the provider’s market position. A well-established provider with a significant market share is often more stable. They have the resources and experience necessary to manage risks effectively and honor guarantees.

Check Their Experience and Expertise

Experience counts. Providers with a long history in issuing bank guarantees are typically more reliable. They understand the nuances of the process and can guide you through it smoothly.

Evaluating Provider Experience

Look for providers with a track record in the industry. Experienced providers have weathered various market conditions and are better equipped to handle challenges. Their historical performance can offer insights into their reliability.

Assessing Expertise in Specific Types

Consider the provider’s expertise in the specific type of guarantee you need. Some providers specialize in certain areas, such as international trade or construction. Choosing a provider with relevant expertise ensures that they understand the unique requirements of your transaction.

Understanding Their Client Base

Review the provider’s client base to gauge their experience. Providers who work with large, reputable companies are likely more reliable. A diverse client base also indicates versatility and the ability to handle different types of guarantees.

Understand Their Terms and Conditions

Make sure you thoroughly understand the terms and conditions associated with the bank guarantee. This includes the fees involved, the process for claiming the guarantee, and any limitations or exclusions.

Reviewing Fee Structures

Examine the fee structure to understand the costs involved. Compare fees across providers to ensure you’re getting a competitive rate. Be aware of any hidden fees or charges that could increase the overall cost.

Analyzing Claim Processes

Understand the process for claiming the guarantee. A straightforward, transparent process is crucial in ensuring that you can access funds quickly if needed. Complicated or unclear processes can lead to delays and frustration.

Identifying Limitations and Exclusions

Identify any limitations or exclusions in the guarantee terms. These could affect your ability to claim the guarantee or reduce the amount recoverable. Ensure that you fully understand these terms to avoid surprises later.

Assess Their Customer Service

Reliable customer service is crucial. You want a provider who is responsive and can address your concerns promptly. Test their customer service by reaching out with questions and noting how quickly and effectively they respond.

Testing Responsiveness

Contact the provider with queries to test their responsiveness. Quick, helpful responses indicate strong customer service. Slow or unhelpful responses may suggest potential issues in the future.

Evaluating Service Quality

Assess the quality of service provided. Are the representatives knowledgeable and courteous? High-quality service indicates that the provider values their clients and is committed to supporting them throughout the guarantee process.

Considering Support Availability

Consider the availability of customer support. Providers offering 24/7 support can assist you at any time, which is crucial in urgent situations. Limited support hours might leave you without help when you need it most.

Seek Recommendations

Ask for recommendations from peers or financial advisors who have experience with bank guarantees. They can provide insights into their experiences with different providers and help you make a more informed choice.

Gathering Peer Insights

Reach out to peers in your industry for recommendations. Their firsthand experiences can provide valuable insights into the reliability and service quality of different providers. This information can be instrumental in your decision-making process.

Consulting Financial Advisors

Consult financial advisors for expert recommendations. They have experience with various financial products and can offer guidance on reputable providers. Their insights can help you navigate the complexities of selecting a provider.

Exploring Online Forums

Explore online forums and discussion groups for additional recommendations. These platforms can offer diverse perspectives and experiences, helping you gather a broad range of insights on potential providers.

Practical Tips for Aspiring Novelists, Content Marketers, and Graduate Students

While this guide focuses on bank guarantees, the skills you’ll develop in researching and evaluating options are transferable to writing and content creation. Here are some practical ways to apply these skills:

For Aspiring Novelists

Character Research

Just as you’d research a bank guarantee provider, research your characters. Understand their backgrounds, motivations, and potential conflicts to create well-rounded, believable characters. This depth will make your characters relatable and engaging to readers.

Plot Evaluation

Evaluate your plot’s “financial strength” by ensuring it has a solid foundation and logical progression. This will help you create a story that holds up under scrutiny. A well-structured plot captivates readers and keeps them invested in the story.

Setting Analysis

Analyze your story’s setting to ensure it enhances the narrative. A well-developed setting adds depth and context, enriching the reader’s experience. Consider how the setting influences the characters and plot, and ensure it aligns with the story’s themes.

For Content Marketers

Audience Research

Much like researching providers, conduct thorough audience research to tailor your content to their needs and preferences. Understanding your audience ensures that your content resonates and engages effectively. Use analytics and surveys to gather insights into their interests and behaviors.

Content Strength

Assess the “strength” of your content by ensuring it is engaging, informative, and provides value to your audience. High-quality content builds trust and authority, encouraging audience loyalty. Regularly review and update content to maintain its relevance and impact.

Distribution Channels

Evaluate the effectiveness of your distribution channels. Ensure that your content reaches the intended audience through the right platforms. Analyze performance metrics to optimize your content strategy and maximize reach and engagement.

For Graduate Students

Source Evaluation

Evaluate the credibility and reliability of your academic sources as carefully as you would a bank guarantee provider. Reliable sources strengthen your arguments and enhance the quality of your research. Cross-check information from multiple sources to ensure accuracy.

Argument Structure

Ensure your arguments have a strong structure, much like a reliable bank guarantee has a solid foundation. A well-organized argument is persuasive and easy to follow. Use clear, logical progression to present your ideas effectively.

Thesis Development

Develop a strong, clear thesis that guides your research. A well-defined thesis provides direction and focus, enabling you to build a cohesive argument. Regularly revisit your thesis to ensure that your research aligns with your central argument.

Conclusion

Choosing a reliable bank guarantee provider is a vital decision that can impact your financial security. By understanding what to look for and how to evaluate different providers, you can make a choice that aligns with your needs and provides peace of mind.

Remember, the skills you develop in making this decision can also enhance your writing and content creation efforts. Whether you’re crafting a novel, creating content, or writing an academic paper, applying these evaluative skills will lead to stronger, more impactful work.

Happy choosing and writing!